Crypto How To's

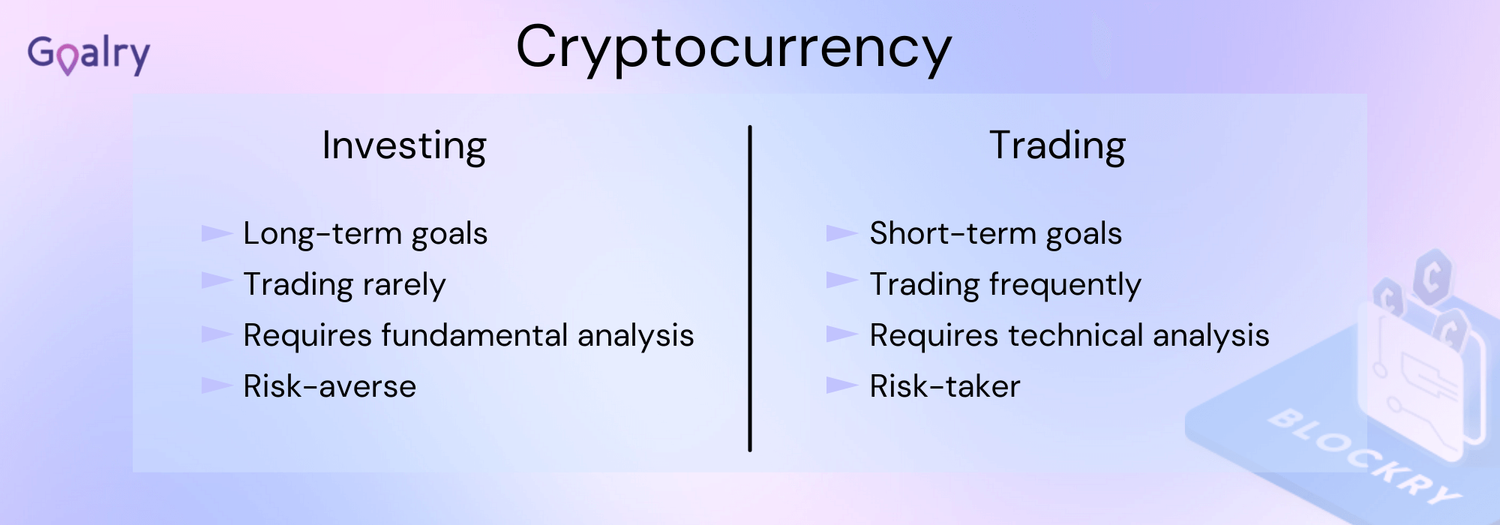

Investing implies committing your money to something long-term in hopes of a reliable return. You identify investment vehicles you believe have the best potential to grow your assets over the years, then invest in them and largely leave them alone. Whether it’s cryptocurrency, some other new technology, innovative financial products, or particular stocks, you may monitor your investment, but the smart investor only periodically makes changes. You don’t tinker; you adapt when something big happens in your life or in your investment portfolio.

Our job here at Goalry is to help educate and inform you of what you’re getting into when you decide to invest in Bitcoin or other cryptocurrencies. Whether or not crypto is a good investment largely depends on you - your goals, your current resources, and how much time you’re willing to invest in understanding the potential benefits and pitfalls of crypto assets. As with any investment, watch the market, but keep in mind that past performance is no guarantee of future results. That’s never been more true than when investing in digital currencies.

Buying cryptocurrency for any reason is a leap into the great unknown, whether you stick with familiar names and buy Bitcoin and Ethereum or take your chances with some other digital currency. Whether you’re looking to diversify your investment portfolio or simply decide to open a crypto account instead of buying lottery tickets this month, the final responsibility for what you choose to do with your resources… is yours.

Let’s start by clarifying a few general terms which are often used interchangeably but reflect two very different approaches - trading cryptocurrency vs. investing in cryptocurrency.

When it comes to buying cryptocurrency as an investment, that means doing your research and making some big choices before you start investing. For retail investors (normal folks like you and I), that usually starts with analyzing various brokerage services. Individuals can’t typically buy stocks or bonds directly. There are a wide variety of brokerage options. In recent years, online brokers have become increasingly popular with retail investors looking for easy options or wishing to control their own investment decisions. A few online brokers offer a limited number of transactions for a flat fee; others operate on a per-trade percentage (which may change based on your trading volume).

Some brokerage services offer investment advice and the option to merely select from “low risk”, “medium risk”, or “high risk” packages they design. Others merely execute the transactions requested for a small transaction fee. In the 21st century, you have more options than ever before - but that also means you have greater personal responsibility to decide what to do with those options. (For example, if you’re here, you’re trying to decide whether or not purchasing crypto is a good investment for you.)

Once you’ve made your decision, it means resisting the urge to keep buying and selling every time the market twitches a bit. Any gains you might make are in danger of being quickly eaten up in transaction fees. You’ll make all kinds of money for the cryptocurrency exchanges involved, but you may not be doing your bank account any favors.

Obviously, if your investment loses value long-term, you’ll wish you’d sold along the way. Then again, if you do sell, and the value later increases, you’ll wish you’d been patient. That’s how most investing works, of course, but cryptocurrencies are in many ways an asset class of their own. They’re one of the most exciting financial products available, but also one of the most potentially problematic. The same excitement that has you researching crypto right now is what makes it difficult to ride out the rises and falls long-term. Given how easy it is to connect to your favorite crypto exchange from any of a dozen internet connected devices, long-term investing requires self-discipline 24/7.

The crypto world has a term for investing and then waiting out the chaos - the HODL approach (hold on for dear life). This intentional misspelling of “hold” simply means that when prices rise and fall, you don’t buy or sell your cryptocurrencies. “HODLing crypto” is an act of faith and patience. It’s far too early in the game to know whether or not it’s a brilliant strategy or a foolish commitment to a “pretend money” bubble.

Trading cryptocurrency, as the term suggests, is much more active, but it doesn’t necessarily mean what it sounds like it should.

You could certainly play the crypto market by purchasing crypto when you think its value is about to rise then staying ready to sell cryptocurrency the moment you think its value has peaked. This could mean staying active with a number of different crypto exchanges or engaging in peer-to-peer transactions throughout each day - including trading different types of crypto. The problem is that such an approach relies on regular, repeated small gains rather than big payoffs on specific crypto purchases. Given that most exchanges charge transaction fees, regular trading can easily cost more than you gain in the process unless you’re trading directly with other crypto aficionados.

What most folks mean when they talk about “trading crypto” is speculation via CFD. A CFD is a “contract for difference” - a popular type of financial contract between you and another party in which you’re basically betting on whether the value of a particular commodity is going to go up or go down between now and a date you specify in the contract. CFDs can be used to bet on digital currencies, fiat currencies (the relative value of foreign currencies to the U.S. dollar over a set period of time), stocks, or pretty much anything else, as long as both parties agree.

It’s not so different from betting on next weekend’s big game and predicting the point spread. You don’t have to be at the game or even own one of those big foam fingers with one team’s name on it to bet, and you don’t actually have to own digital currency to predict its rise or fall in value. Let’s say that you’re convinced that between now and sixty days from now, Bitcoin will go up in value. You contract with a peer who is certain it will go down. In sixty days, if Bitcoin has gained value, you make a profit based on the difference. If it’s dropped, you lose the difference between the value today and the value on the date specified. No Bitcoin (or Ethereum, or Tether, or Solana, etc.) changes hands.

This is a slightly oversimplified version of a CFD, but hopefully it gives you the general idea. When you hear talk of speculators going “long,” they’re betting on a rise in value. When they sell “short,” they’re betting on a fall in value. Most of the time, when you hear or read about people trading cryptocurrency, this is what they actually mean.

Crypto mining is only “mining” in the sense that it creates new “coins” (or similar digital assets, depending on the specific cryptocurrency). The term is most closely associated with Bitcoin and its use of blockchain technology. Many major crypto investors never actually had to buy Bitcoin to begin with - they “mined” their digital currency.

“Mining” refers to the process of validating crypto transactions and the competition to be the user to lock them into the blockchain. The process requires solving complex mathematical problems which become more involved as more users join the fray. That means special software and substantial computer power, not to mention electricity and constant updates and expansion to offset those doing the same thing around the world. In short, it’s become a very specialized process largely controlled by a small number of mega-networks using a vast amount of resources to mine new Bitcoin.

Dozens, hundreds, or even thousands of third-party users essentially compete for the opportunity to “sign off” on the transaction and permanently add it to the ongoing blockchain - the “ledger” of all Bitcoin transactions ever conducted. The “winner” earns a small number of new Bitcoins - digital currency which did not exist prior to their service and which will eventually be capped off at an amount determined when Bitcoin was first introduced.

Blockchain technology is often compared to a shared “ledger” recording every transaction using Bitcoin. (Many other cryptocurrencies have their own blockchain technology or use alternative methods to maintain their “ledger.”) Because there are no central banks or national governments regulating transactions, users must collectively verify the validity of each exchange before “locking it in” by adding it to the blockchain. Once a transaction is converted into a permanent block of data using what’s called a cryptographic “hash” function, it cannot be changed - ever, by anybody. At least, that’s the idea. That’s why it’s important that when any two parties agree to an exchange of Bitcoin, the transaction must be verified by each of them as well as a third party. That’s where Bitcoin mining comes in.

Some users have formed their own collectives to create “mining pools.” As the term suggests, these combine the resources of multiple users to chug away and the mining process, then share any Bitcoin created in the process. While you are unlikely to become a major Bitcoin (or other cryptocurrency) miner on your own, you may manage to earn a trickle of crypto income via the right mining pool. Be ready to devote enormous computer resources to the process, as well as potentially doubling or tripling your electric bill in the process.

Many of the newer cryptocurrencies utilize less resource-intensive means to validate transactions. Some of these are still opportunities to “mine” new digital assets, but whether or not the effort proves profitable largely relies, of course, on the rise or fall in the value of that particular cryptocurrency over time.

One of the advantages of fiat currencies (money backed up by a major government) is their relative stability. It’s generally considered “bad” when the value of the U.S. dollar fluctuates too dramatically, for example. (If you don’t believe me, just watch the evening news.)

In the world of cryptocurrency, however, change is the norm. Not surprisingly, people are finding all sorts of new ways to profit from their crypto investments. Keep in mind that this means many others are finding ways to take advantage of or outright defraud crypto investors. Don’t get carried away by headlines and promises and the stories you’re told by that guy at the shop. Do your homework and focus on what’s best for you and your long-term investments.

Once it became clear that the verification process for Bitcoin transactions (“Bitcoin mining”) was resource-intensive and unintentionally exclusionary, cryptocurrency innovators turned to other methods for validating crypto transactions. One popular approach is called the “proof-of-stake” protocol (PoS). You may also encounter an updated version of this called the “nominated proof-of-stake” (NPoS).

The details of how it works aren’t all that important for our purposes, but basically it replaces massive computing power with a “stake” of cryptocurrency as a means of validating the third party acting themselves as validation of a crypto transaction. (I know, it gets a bit hairy keeping it all straight!) The simplified version is that the system allows you to put some of your crypto on the table as proof you’re legit. The more crypto staked, the better the chance you’ll be randomly selected to validate the transaction (like buying multiple squares on the office betting pool come Superbowl time).

If chosen, your computer validates the transactions and receives a small amount of cryptocurrency for your trouble. Some cryptocurrencies use hundreds or thousands of validators, so the amount staked must be high and the returns on a single transaction can be minimal. The idea is that over time, a trickle of income accumulates exponentially.

Participating requires a substantial investment of your time and computer resources, so it’s not a game for the casual investor. And, much like with Bitcoin mining, the more people who get involved, the more you have to bring to the table just to remain in the game.

Not surprisingly, however, a system has been developed for allowing smaller users to pool their resources in order to stay in the staking game. There are online options for delegating a portion of your crypto to a collaborative who then applies it to PoS or NPoS as part of a larger stake. Your returns are of course in proportion to your contributions.

Crypto staking isn’t considered particularly risky, but it is possible to lose over time depending on how quickly the market capitalization of your crypto fluctuates during the staking period. It also requires tying up a substantial portion of your crypto for periods of time, meaning you can’t sell it or use it for anything else during your staking commitment.

You can approach crypto lending from at least two different angles.

First, crypto can be used as collateral for a loan in much the same way as any other item of value - real estate, automobiles, savings accounts, etc. It’s increasingly common for banks, credit unions, or reputable online lenders to accept crypto as collateral for personal loans. This tends to reduce (but not eliminate) the importance of your credit score in determining whether or not you’re approved and to secure better interest rates and other terms for the life of the loan.

Because cryptocurrency values are known to fluctuate dramatically, many lenders will retain the right to demand further collateral or a complete payoff of the loan if the value of your digital assets falls below a predetermined point. Never assume that you’re the one guy in the world with a foolproof plan or better insights than anyone else in the business; have a backup plan for what happens if your crypto’s market capitalization drops before you’ve paid back the loan!

The second approach to crypto lending is one many crypto investors have been using to grow crypto wealth with relatively low risk. Although it’s called “crypto lending,” it’s really more like what we think of as “saving,” just like you’d invest fiat money in a local bank or credit union in hopes of a profitable rate of return.

Interest rates for traditional savings accounts have been abysmal lately, but some crypto aficionados have been garnering returns as high as 10% of their investment. Essentially, crypto lending means entrusting your crypto to a lender who pays you for its use. They in turn loan out crypto to others for an even higher rate than what they’re paying you. If everything goes according to plan, everyone wins - the borrower is able to access the crypto they’ve requested, the lender makes a reasonable profit, and you get your cut for doing basically nothing.

Crypto lending is one of the most volatile sections of the cryptocurrency world at the moment. Unlike traditional banks and credit unions, there’s no FDIC to protect you if the lender collapses or simply takes your money and vanishes. Congress hasn’t yet decided exactly how they’ll regulate crypto lending, but you can bet they’re going to try something eventually - and there’s no telling what that might look like.

So, while crypto lending isn’t the same sort of risk as investing in crypto as part of your long-term investment portfolio, it’s far from a sure thing.

Any of these options require educating yourself and doing your homework before beginning. As with any financial products or strategies, the final responsibility for making the big decisions is yours.

At Goalry, we believe that most of us are capable of taking more effective control of our personal or small business finances if only provided the same information, connections, and opportunities as those further along the path.

There are many more established and reliable ways to improve your credit, reduce your debt, and invest in your future than speculating on cryptocurrency. If you choose to play, however, we’ll keep breaking down the language and offering expert insights to give you the best chance possible of coming out ahead. We already offer tools to help you track your spending, choose the best investments or insurance, determine accurate real estate values, or find the right mortgage refinancing offer for your specific circumstances. We’ll soon be adding crypto portfolio management as well, so stick around.