Crypto Basics

Money of any sort relies on a degree of “faith.” Unless the object we’re using as currency has inherent value (it can be used for something besides trading it for other things), we accept it based on what it represents.

There’s no central authority backing it up and no reserve of gold or other valuables supporting its worth. It is valuable solely because enough other people are willing to consider it valuable. The more people who believe in digital currency, the more value it has. When that belief wavers, the total value falls. In that sense, cryptocurrency works a little like the chips used by major casinos in place of cash. They cost real money and can be used in a variety of transactions, but only with others who understand and agree with their value. If the casino ever goes out of business, the tokens themselves become worthless.

Unlike traditional currencies, there are no paper bills, and despite the names of several popular cryptocurrencies, there are no “coins” in the traditional sense. The units of value exist online, stored in a decentralized fashion so that the system never relies on a single server or organization to remain functional. Many digital currencies have a preset limit on total “coins” produced, but this doesn’t limit the total value of those coins. That’s entirely up to users and the marketplace.

If cryptocurrency is so “intangible” compared to traditional dollars and cents, why are so many people drawn to it? There are several common reasons:

In other words, it’s an investment strategy. Because the risk is so high and the future so unpredictable in this particular situation, however, many experts prefer to categorize this approach as “speculation” more than “investment.” Buying crypto is more like purchasing a lottery ticket than investing in stocks or bonds.

There are a few notable examples of systems being hacked and exploited, but crypto is considered far more “secure” than traditional currency.

They are not managed by central banks or tied to specific financial institutions, economic systems, or governments. There’s no oversight (in most places) other than the watchful eye of the crowd which verifies each transaction repeatedly for maximum security. This means very few fees or other costs associated with financial transactions. Time and place have little impact as well; funds can be transferred from anywhere in the world to anywhere else in the world almost instantly, any time of day or night. The decentralized nature of digital currency makes it very difficult for governments (or law enforcement agencies) to monitor transactions. While many consider this a major benefit, even for perfectly legal exchanges, others believe this is one of the major downsides to the growing popularity of digital currencies across the world.

“AltCoin” refers to pretty much any cryptocurrency that isn’t Bitcoin. Bitcoin has been such a dominant player in the world of crypto that other cryptocurrencies are “alternative coins” - which shortens to “altcoin.” Conventional wisdom suggests many of these other cryptocurrencies have made improvements in terms of computer code, blockchain management, or other features. Different coins present their initial coin offering in different ways and may establish their own cryptography for peer-to-peer transactions. At the same time, past performance suggests extreme price volatility with alternative crypto. Bitcoin has proven unpredictable as an investment, but altcoin currency has so far been even more so. Anything’s possible moving forward, but most experts recommend you steer clear of altcoin as a primary investment. As always, if you decide to roll those dice anyway, never risk more than you can afford to lose. There are simply too many other reliable financial products out there to commit your future to cryptocurrency - especially altcoin.

Have you ever worked on a document online that’s “shared” with others? You can watch their cursors moving and see what they’re typing in real-time. Anyone sharing the document can look at the history of changes as well. If someone accidentally erases something, it’s easy to find out who made the change and fix it. Now imagine that shared document is actually a financial ledger with every transaction in the world being entered into it as they occur. The record-keeping is part of the transaction itself; the funds only change hands because the terms are being recorded in the shared digital ledger. This is a very simplified version of a blockchain system. Everyone can see every transaction and every change is verified and saved by everyone involved. Everyone using the same crypto system manages the ledger along with other users. The security of the system is partly based on the transparency of it all. (Names are encoded so that users are easy to track but difficult to associate with individuals in the real world.) Further security is provided by the method of storing this information permanently. As each exchange is verified, the information is stored permanently in a “block” of data and added to the “chain” of every other transaction that’s ever occurred with that cryptocurrency. This “blockchain” is nearly impossible to alter afterward because there are thousands of exact copies made by other users around the world, over and over as things progress. High-powered computers constantly compare the blockchain with other copies so that any discrepancies are identified almost immediately. Cryptocurrency transactions are thus some of the most secure in the world.

While it’s possible to buy and sell crypto directly with other users, it’s generally considered much safer (especially at first) to utilize reputable cryptocurrency exchanges, sometimes called “trading exchanges.” Cryptocurrency exchanges are online marketplaces that allow users to buy, sell, or trade various cryptocurrencies. They are in some ways comparable to the currency exchange booths at most international airports, where you can convert your dollars to lira, francs, or yen. Some offer “hot wallet” services or even a sort of “savings account” in which you can store your cryptocurrency and possibly even earn a small bit of interest along the way. As with any online institution, it’s important to do your homework and verify the legitimacy of any organization before sending them your hard-earned money. Even among reputable services, transaction fees and other terms vary widely, so pay attention to the small print at every stage and don’t commit to anything you don’t fully understand! Expect to pay a small fee for each service rendered, but if you’re purchasing cryptocurrency as an investment, you don’t want to pay more than necessary for basic transactions.

Even though digital currency lacks a physical form, users still refer to their personal storage systems as “wallets.” At its most basic, a cryptocurrency wallet is comparable to any other method of storing information. It’s more specific than most other forms, and - hopefully - more secure. A “hot wallet” is managed online. (Think “the cloud.”) Many trading exchanges offer this service for free with your membership, although some users prefer to choose from the many third-party providers out there.

A “cold wallet” is offline. (Think “flash drive” - but with multiple levels of security.) These are small, portable devices with their own advanced encryption that allow you to “keep” your cryptocurrency with you. Any purchases or exchanges, of course, still require online interaction.

“DeFi” is another compact bit of shorthand, this time for “decentralized finance.” In the world of cryptocurrencies, it refers to financial apps which circumvent established institutions. In other words, it allows peer-to-peer transactions without banks or governments getting involved. The term does not refer to a specific application so much as an approach to cryptography.Whereas blockchain technology was primarily designed with financial transactions in mind, DeFi takes the basic approach of blockchain and expands it for use with all sorts of interactions. Loans, crowdfunding, insurance, or gambling can all be managed without institutional control, fees, or regulations.

This is a fancy way of referring to the total value of all “coins” of a specific cryptocurrency. It’s easy enough to compute - you take the total number of coins in existence and multiply them by the current exchange value of each coin. This number can change daily, or even hourly, based on market fluctuations or the mining of new coins.

It takes a great deal of computing power to do all the verification and comparisons described above. In order to motivate more users to take part, many cryptocurrencies offer rewards for those able to do provide these computations the fastest. The actual logistics of the system are a bit tedious, but the short version is that for each new transaction, thousands of computers race to verify and store the correct information. The computer which does this first each time earns a small amount of new cryptocurrency - a “coin,” as it were.The computing power necessary for successful crypto mining is substantial. It’s not just about speed - the system utilizes sophisticated cryptography to keep transactions secure. It’s increasingly difficult for anyone other than established organizations to profit from the effort.

In general terms, “nodes” are any point of connection or interaction between different parts of a computer network or networks. Each node has a unique identification so it can be recognized by the rest of the system. When you get a new printer, for example, your computer has to “find” and identify it before the two can communicate effectively. Once recognized, however, you can print from your computer to the device or scan documents from the device to your computer. Your printer is a node, as is your computer, your modem, and the web server that lets you post pictures of your kids to the family blog. When talking about blockchain, a node is any device connected to that blockchain “ledger” described above.

This is a rather elastic term that has meant different things in different settings over the years. In general, however, it refers to any arrangement which “cuts out the middle man.” If you want to sell your car, for example, you may go to your local dealer and trade it in towards a newer model. They’ll then fix it up and sell it to a different customer. Or, if you prefer, you can take out a few ads or make a few posts on social media and try to sell it directly to the person who’ll be driving it next. When you buy and sell without assistance from a specialized institution, that’s peer-to-peer. Transactions involving cryptocurrency are considered “peer-to-peer” because no central bank or other financial institution is involved. One party makes arrangements with another without requiring the approval or facilitation of a third.

This one can be a head-spinner if you’re new to cryptocurrency. In many contexts outside of cryptocurrencies, the words “coin” and “token” can mean pretty much the same thing - a little round item that acts as currency and can be used to buy and sell, make a payment, etc. Even in the world of cryptocurrency, they’re easy to confuse. Neither exists in physical form, of course - when new coins are mined, they exist only in cyberspace. Tokens, too, are digital representations of information. Both are considered “cryptocurrency,” despite the fact that tokens in this case don’t act as currency in the traditional sense. But that’s where the similarities end. Coins are units of digital money. They are treated like dollars or yen or francs for most transactions - basic digital currency used as part of a financial exchange. These exchanges are what’s recorded in the blockchain and treated like any other buying and selling, minus a central authority running things and taking its cut. Tokens are digital assets that can be very roughly compared to having “shares” in a company. They can be traded, bought, or sold within their system, but unlike coins, they imply participation in the overall network. A hint of mutual ownership, but also more specific than coins. If you have season tickets to your city’s NBA or NHL team, you have items of value that can be exchanged with other fans, but have little inherent worth for paying your electric bill or checking out at the grocery store. On the other hand, they entitle you to attend the games and participate in events reserved for season ticket holders - you’re part of “the network” around the team.

If you write a check, the merchant accepts on faith that you have funds in your checking account. If you use a credit card, the issuing company believes in your ability to make payments on the balance and interest forever and ever and ever. If you pay for dinner with a $20 bill, anyone accepting that cash trusts in the reliability of the United States government and our national economy.

Like most innovations, cryptocurrency evolved as much as it was “invented.” The concept of digital currency with no central authority behind it, possibly managed via open source software and available for peer-to-peer exchange, was being discussed as far back as the 1980s. A few early efforts fell flat and the idea seemed doomed to become a footnote in economic textbooks.

Then, in 2009, a paper was published under the pseudonym “Satoshi Nakamoto” which laid out the possibilities of blockchain and an entirely digital currency - what we today call “Bitcoin.” The blockchain process was revolutionary. Each transaction is verified by not only the buyer and the seller, but third parties as well. Because usernames are encoded using sophisticated cryptography, the process is simultaneously transparent and private.

Bitcoin took off, leading to a number of imitators and even more innovators seeking to improve on blockchain technology. While there’s little doubt many altcoin creators would like to profit off their innovations, there’s also an indefinable drive common among engineering and technological types to keep trying to improve stuff just to see if they can. That’s why even though the vast majority of the thousands of cryptocurrencies out there today have shown little indication they’ll be taking off anytime soon, we can safely expect another few thousand any day now.

Comparing crypto is a much messier proposition than comparing national currencies around the world. Different cryptocurrencies use entirely different methods of conducting transactions, making payments, transferring funds, or investing in future growth. Each type ledger is unique and may have its own approach to cryptography and security. Plus, many altcoins aren’t even the primary function of the blockchain or other decentralized processing with which they’re associated. In other words, some of the most popular crypto in the world at the moment isn’t just about digital coins.

And if that’s not “Wild West” enough for you, any list of cryptocurrencies is incomplete and potentially obsolete the moment it’s published, no matter how many entries are included. It’s simply too new and unstable of a field to offer anything concrete or with the sort of confidence financial experts prefer. And there’s just too much complicated technical stuff.

Instead of going into that, let’s just take a look at a few of the more popular names you’re likely to encounter while reading up on digital currencies and highlight a handful of different approaches to cryptocurrency currently being utilized.

For purely informational purposes, however, here are a few of the more popular cryptocurrencies at the moment.

This list is not a “Top 10.” Experts have yet to develop a consistent standard of comparison for popular cryptocurrency, and ongoing price volatility makes it impractical to judge most based on their “investment” value. Some rank crypto by features or potential, others by market capitalization. The process is inherently subjective, and for now it’s best to steer clear of anything that might be mistaken for an endorsement.

This is the one most people think of when they consider investing in crypto. Bitcoin was the first major cryptocurrency and remains the most popular cryptocurrency in use by a wide margin. For many unfamiliar with the world of digital financial products, “crypto” and “Bitcoin” might as well be interchangeable. In reality, there are literally thousands of other cryptocurrencies currently available. Nevertheless, Bitcoin is the flagship of decentralized digital currency.

To date, Ethereum is the consistent “runner up” in crypto popularity. Like Bitcoin, it uses blockchain technology (also known as “distributed ledger technology”) and operates without central oversight. Ethereum’s claim to fame is its innovation in applying blockchain technology to areas other than digital currency, like business contracts. It’s also known for its “decentralized apps,” or “dApps.” The new coins created by Ethereum are called “Ether.” Ethereum has inspired nearly as many imitators and innovators as Bitcoin itself - maybe even more.

Unlike Bitcoin or Ethereum, Tether’s value is tied to the U.S. dollar. Any cryptocurrency indexed to a traditional currency is called a “stablecoin,” and Tether is the most popular stablecoin out there at the moment. The basic idea is to have the flexibility of cryptocurrency with less volatility. Tether’s managers tweak the supply and other factors as necessary to maintain a value as close to 1:1 as possible with U.S. dollars. In 2021, Tether was one of the top five cryptocurrencies in terms of market capitalization.

While the terms are sometimes used interchangeably, “Ripple” is the company behind the cryptocurrency known as “XRP.” It was one of the earliest peer-to-peer digital currency efforts, but failed to gain traction. After Bitcoin became a thing, they reworked the details and tried again - and here they are. Ripple’s focus upon rebooting was corporate financial transactions and international money transfers. XRP was created to facilitate more efficient exchanges between organizations or individuals using different types of currency.Ripple has its own alternative to blockchain which allows faster transaction verifications without requiring so much raw computing power. XRP coins are “pre-mined.” The timing of their release into the marketplace is determined by a board of investors who seek to maintain stability as well as profitability over the long term.

USDC is a stablecoin (like Tether). It uses Ethereum blockchain technology but its goals are closer to those of other stablecoins - the flexibility of cryptocurrency without the wild fluctuations in value. Unlike Tether, USDC claims to have actual cash and other reserves roughly equal to the value of new coins it introduces into the digital market.

Binance’s primary claim to fame is their status as the most popular cryptocurrency exchange in the world in recent years. It’s perhaps no surprise that they’d decide to offer a digital currency of their own. Binance was originally founded on the Ethereum network but has since developed its own blockchain. Unlike many other cryptocurrencies, Binance controls the number of coins in “circulation” by regularly buying back and “burning” their own digital coins, thus reducing the supply. So far, the strategy seems to be working - they’re in the top five of all cryptocurrencies in terms of total market capitalization for 2021

Stellar isn’t looking to do anything particularly flashy or new, at least as defined by the rest of the crypto world. What they offer instead are the basics done better - faster decentralized ledger transactions, lower fees, minimal volatility. The one thing which does stand out a bit with Stellar is its focus on “anchors.” At their most basic, anchors are holders of value other than digital coins themselves. If you’ve ever received a gift card for Christmas or your birthday, or accrued rewards points at your local coffee shop, you’ve already used “anchors” in the real world. Stellar looks to expand the potential of the same basic idea in cyberspace.

Solana is both a cryptocurrency and an open-source software project run by (who else?) the Solana Foundation out of Geneva, Switzerland. It’s primary purpose is to host dApps - decentralized applications which are hosted on all user servers simultaneously rather than downloaded only to specific devices. Solana’s blockchain is noted for its shockingly fast processing of transactions and very low transaction fees compared to most other offerings.Solana in many ways represents the next stage of evolution in crypto. Blockchain began primarily as a tool for supporting digital currency - a decentralized ledger for peer-to-peer financial transactions with high security and low oversight. The potential for other uses was inherent, but secondary. Now, companies like Solana are developing better and better blockchains for a wide variety of uses, and issuing new coins tied to those blockchains almost as an afterthought. It seems to be working - Solana is a top five cryptocurrency in terms of market capitalization in 2021.

Part of the appeal of cryptocurrency for many users is the lack of central oversight or national regulation. That hasn’t stopped U.S. legislators from stepping in to at least try to impose a few basic limits on this strange new realm of finance. The issue has been debated for several years and is being debated even as these words are being typed, so it’s impossible to say with any certainty what the law might be by the time you read this. In general, however, here are a few things to be aware of:

You’re expected to pay taxes on any profits you make from buying and selling cryptocurrency. The same basic rules apply to digital gains as they do to anything else you do that creates income or profit - even if it’s purely digital.

Congress would really like to find a way to reduce fraud and the proliferation of scams out there using cryptocurrency (or the promise of cryptocurrency) to deceive casual investors. The problem, of course, is that any rules created to reduce abuse tend to inconvenience legitimate users as well. The best thing you can do as an individual is to utilize the same caution you do with any financial “opportunity” - check and double check the legitimacy of everyone involved. Anything that sounds too good to be true, probably is.

Congress is also looking at ways to classify stablecoin issuers as “banks” in the eyes of the law. This is another fraud prevention measure with the potential to both protect consumers and limit what they can do online (at least legally).

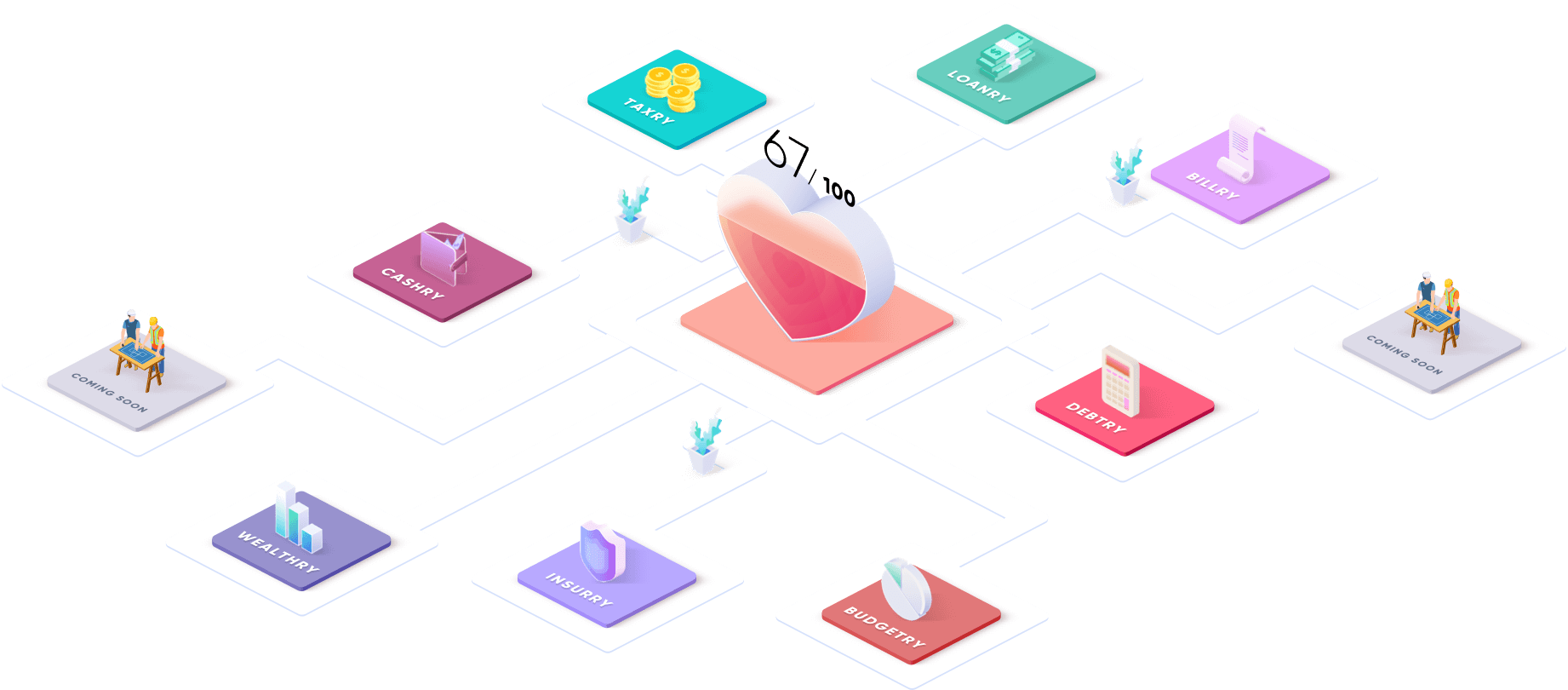

Our guiding philosophy at Goalry is simple: most people are perfectly capable of taking more effective control of their personal or small business finances when provided the same information, connection, and opportunities as everyone else. We don’t tell you what to do with your money - we make it easier to make more informed decisions.

Cryptocurrency is still very much a high-risk endeavor. We’ll soon be adding some features to our financial management apps to allow you to more easily organize, track, and trade your cryptocurrency investments if you so desire. In the meantime, stick around and let’s look at some ways to help you save real money now and strengthen your financial position for the future - no matter what happens in the crypto marketplace.